Advanced Planning

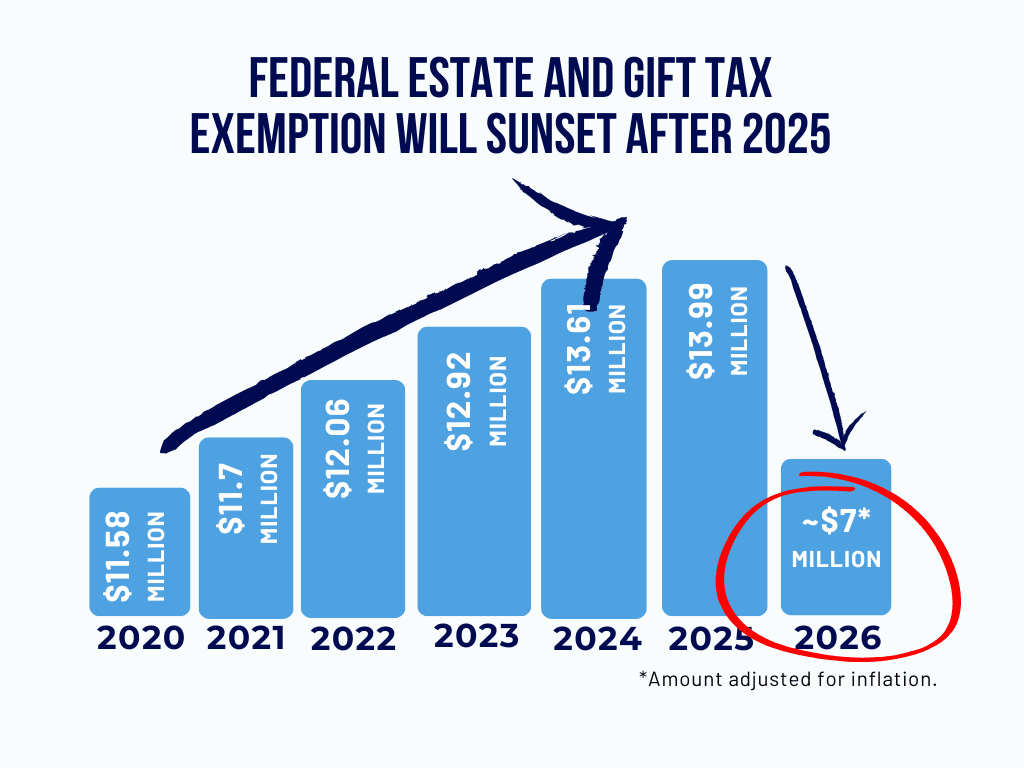

Once your foundational estate plan is in place, advanced strategies can help you preserve wealth, reduce taxes, and protect future generations. Whether you're planning for a high-net-worth estate, a family business, or charitable giving, these tools go beyond the basics to offer greater control, flexibility, and long-term impact. Our team works closely with you to design a customized plan that aligns with your values—and ensures your legacy endures.

Below you will find an overview of the upcoming changes to federal estate tax law, in-depth explanations of key planning strategies—including visual breakdowns—and advanced trusts you may want to consider.

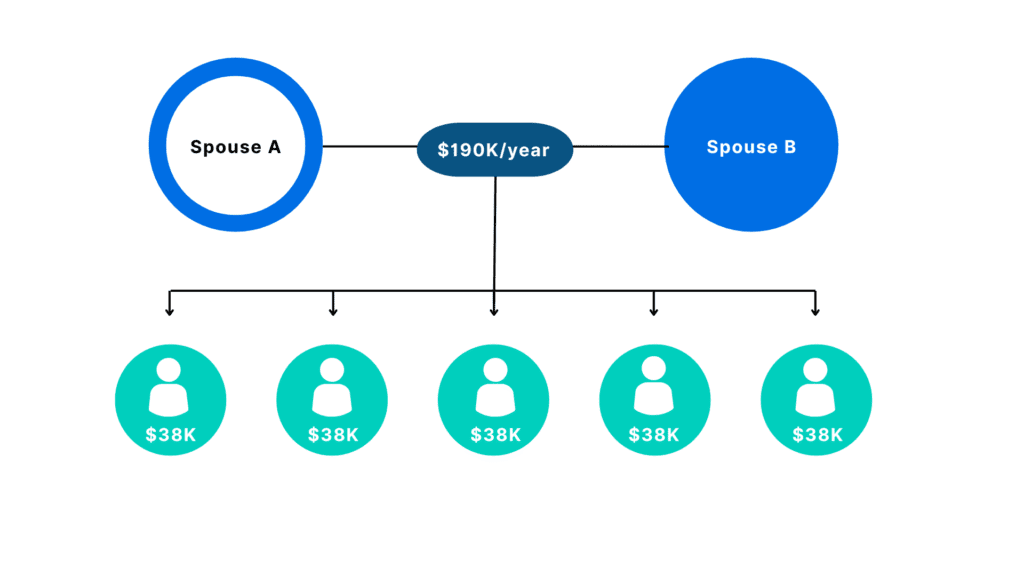

Annual Gifting

Annual gifting allows individuals to give a set amount of money or assets to others each year without triggering federal gift taxes or dipping into their lifetime gift and estate tax exemption. It's a simple and effective way to reduce the size of your taxable estate while helping loved ones during your lifetime.

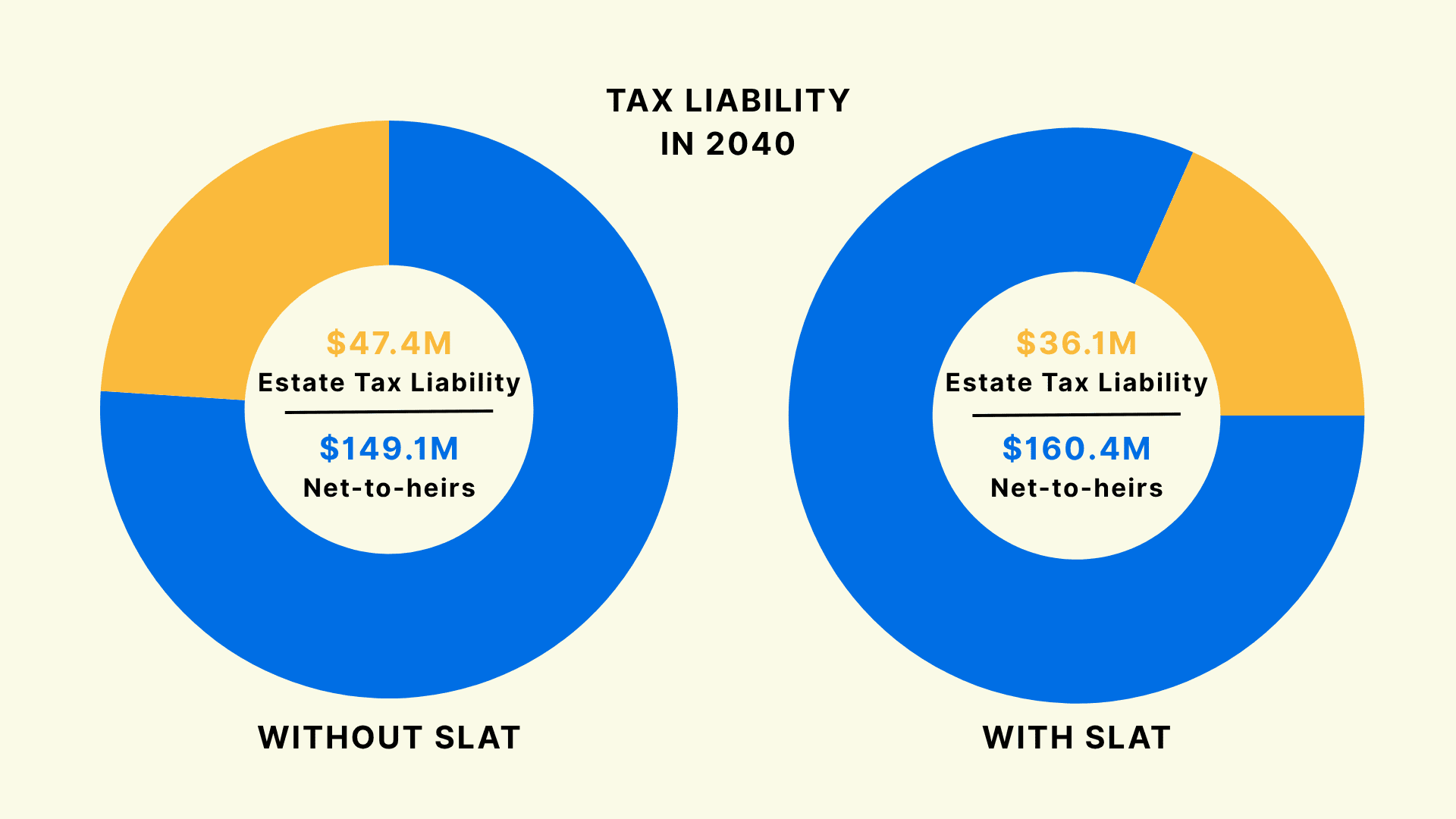

Spousal Lifetime Access Trust (SLAT)

A Spousal Lifetime Access Trust (SLAT) is an irrevocable trust one spouse—known as the donor—establishes during their lifetime, primarily for the benefit of the other spouse and possibly children or other descendants. Funded using the donor’s 2025 lifetime gift tax exemption of $13.99 million, a SLAT enables growth of gifted assets outside the taxable estate while still allowing the beneficiary spouse to receive trust income (and sometimes principal) as needed, without incurring gift or estate taxes. The donor spouse continues to pay income taxes on the trust earnings, effectively making a further tax-free contribution to the trust’s value

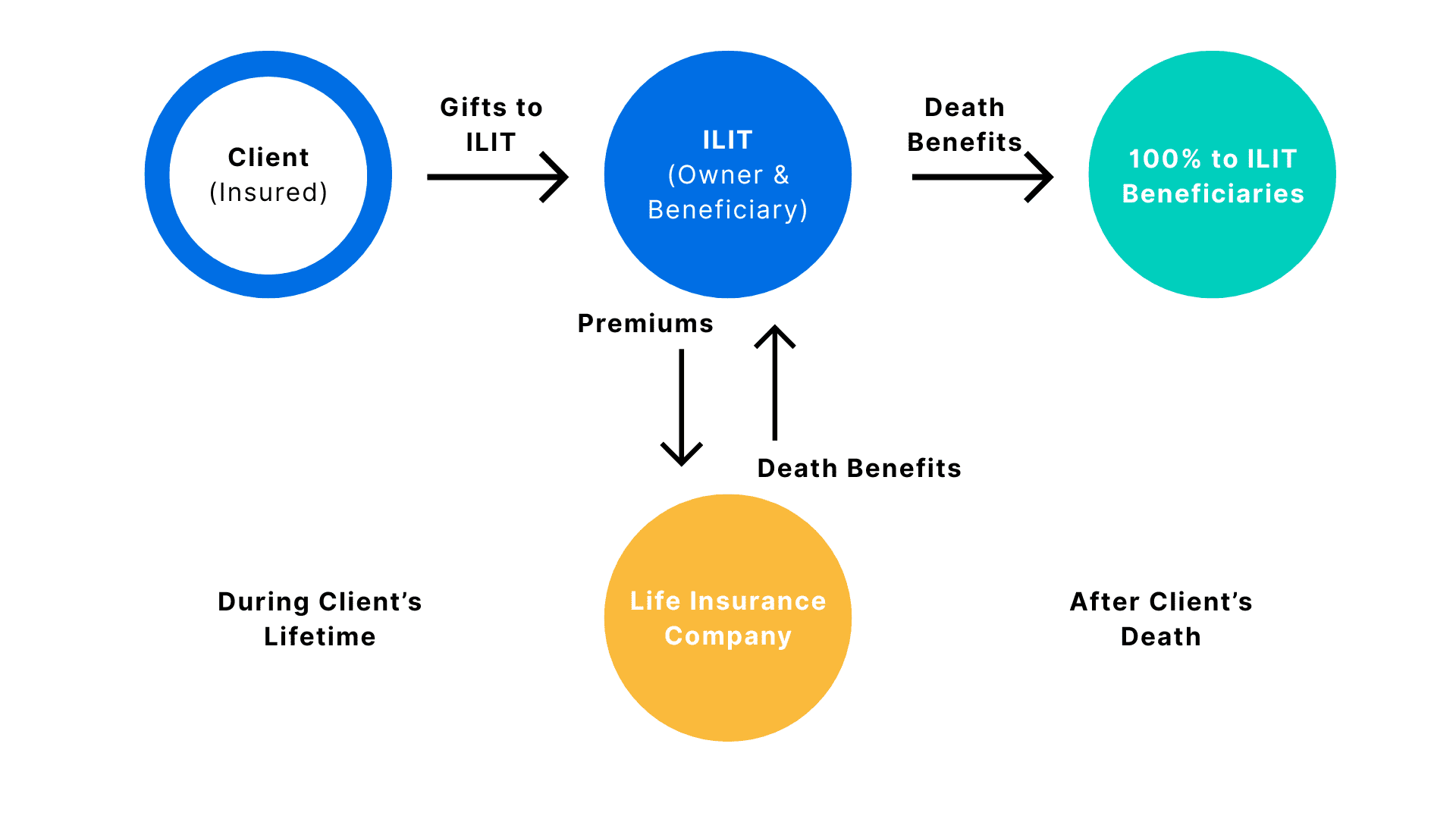

Irrevocable Life Insurance Trust (ILIT)

An Irrevocable Life Insurance Trust (ILIT) is a legal entity created to own your life insurance policy, removing it from your taxable estate at death. When properly funded and structured—with the ILIT owning the policy—the death benefit typically isn’t subject to estate taxes. In 2025, gifts to the ILIT (used to pay policy premiums) can qualify for the $19,000 annual gift exclusion, preserving your lifetime exemption. A well-designed ILIT also offers creditor protection, estate liquidity, and the ability to fund trusts for children, grandchildren, or others without inflating your taxable estate

The Hybrid Domestic Asset Protection Trust

The most important asset protection strategy of the twenty-first century.

The Nevada Incomplete Gift Non-Grantor Trust (NING)

A financial instrument for affluent individuals seeking to mitigate state income tax liabilities and enhance asset protection, particularly in high-tax states.