Insights & Guides

Welcome to our comprehensive resource hub for all things estate planning. Whether you're just starting to explore the idea or are ready to speak with an attorney, the following collection of articles provides valuable insights into the estate planning process. From calculating the value of your estate to designing complex trusts, these articles are designed to prepare you for a productive conversation with a legal expert.

If you are a high net worth individual, please scroll down for specialized content on advanced estate planning and tax strategies tailored to meet your unique financial needs. This section dives deeper into the strategies that can maximize your legacy and minimize tax liabilities.

Do You Know What You Own?

Trying to create an estate plan without a clear picture of your finances is like planning a journey without knowing your beginning point.

Learn how to calculate your net worth.

The Top Ten Estate Planning Issues

The most common estate planning pitfalls and how to avoid them.

Have You Considered a Dynasty Trust for Your Family’s Estate?

Despite its name, a dynasty trust isn’t just for the ultra-wealthy; it’s an accessible option for a broader range of families than many realize.

Wills, Trusts, and Dying Intestate: How They Differ

Three scenarios illustrating what will generally happen when you die, whether you pass away intestate (without a will or trust), with a will, or with a revocable living trust.

How to Pick a Trustee, Executor, and Agent under a Power of Attorney

Knowing what each role involves and considering your options carefully can help ensure the effectiveness of your estate plan.

Should Your Child’s Guardian and Trustee Be the Same Person?

With two different people serving in these roles, you can ensure that you have the right person for each job if one person is not ideal for both.

Who Should You Name as Beneficiary?

Buying life insurance is key to securing your loved ones’ financial future after you are gone, but careful beneficiary selection is crucial to ensure they receive the intended benefits.

Advanced Planning Strategies

What Is a NING Trust?

The Nevada incomplete gift non-grantor (NING) trust is a financial instrument for affluent individuals seeking to mitigate state income tax liabilities and enhance asset protection, particularly in high-tax states.

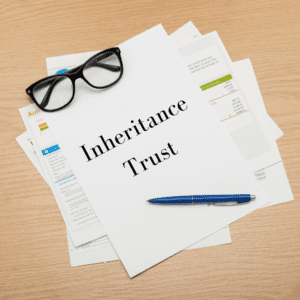

What is an Inheritor’s Trust?

An inheritor’s trust is a sophisticated, but powerful estate planning tool. It is ideal for anyone who is to receive a substantial, outright inheritance that may need additional asset and tax protection.

The Hybrid Domestic Asset Protection Trust

The most important asset protection strategy of the twenty-first century.

Spousal Lifetime Access Trusts (SLAT)

A SLAT is an irrevocable trust where one spouse transfers assets out of their estate into a trust for the other, reducing estate value while retaining limited access for the beneficiary spouse, maximizing lifetime gift and estate tax exclusions.

Creative Uses for Life Insurance

Life insurance offers significant benefits beyond supporting financial dependents, serving married couples, empty nesters, retirees, business owners, and investors with perks that many may not initially consider.